Rmd calculator for 2022

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401k account this year. Our RMD calculator.

Your Search For The New Life Expectancy Tables Is Over Ascensus

This could have tax implications.

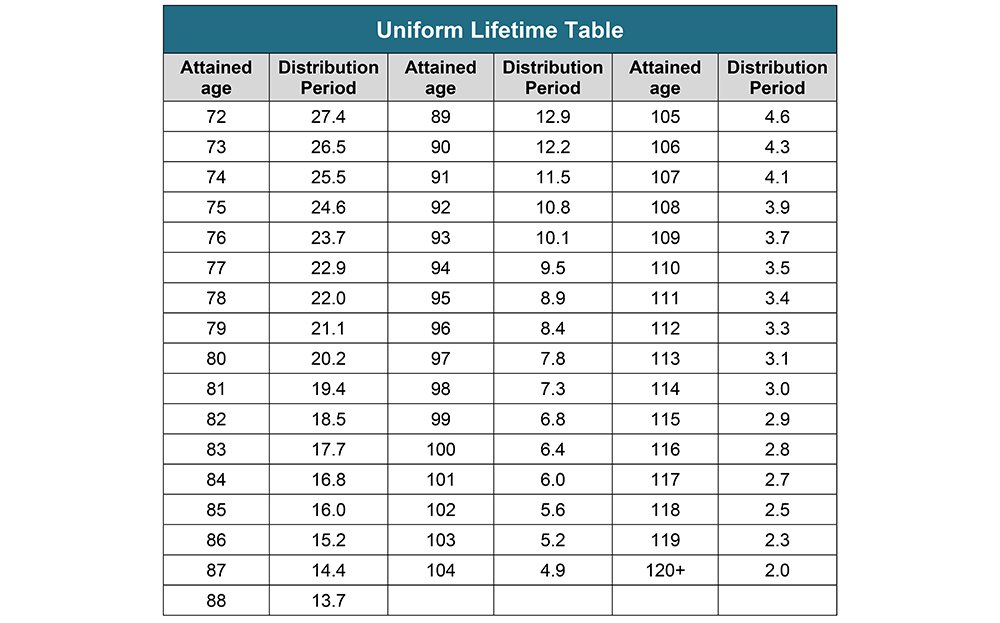

. RMDs are waived for 2020 and. If you were born on or after 711949 your first RMD will be for the year you turn 72. The IRS has published new Life Expectancy figures effective 112022.

The new tables are not effective until 2022. The life expectancy of the oldest beneficiary will be used to calculate the RMD. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

Beginning at age 72 you must take required minimum distributions RMDs from those accounts which means you wont be able to defer paying taxes on earnings indefinitely. After that your RMDs must be taken by Dec. The custodian of my account is telling.

The SECURE Act of 2019 changed the age that RMDs must begin. I know the minimum withdrawal requirements and when. If you inherit an IRA RMD rules apply.

I turned 72 in August of 2022. View analysts price targets for RMD or view top-rated stocks among Wall Street analysts. Complete your first RMD by April 1.

Westend61 GettyImages. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Divide that factor into the account balance on December 31 2021 to arrive at your RMD for 2022.

Do I need to wait for. The IRS has good news for retirees starting in 2022. Use this calculator to determine your required minimum distributions RMD from a traditional IRAThe SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July 1.

The SECURE Act changes the distribution rules for beneficiaries of account owners who pass away in 2020 and beyond. For the first time in 20 years the Internal Revenue Service has updated its actuarial tables that dictate how much a person is required to withdraw from his or her retirement. Their RMD share price forecasts range from 25000 to 28000.

Call us at 866-855-5636. Complete your second RMD by December 31. Youll have to take another RMD by Dec.

For 2022 I was expecting to use 285 as the divisor. Saving for retirement in a 401k at work or a traditional individual retirement account IRA can help you build wealth for the long term while enjoying some tax advantages. Thats because on November 6 the IRS released new life expectancy tables that are used to calculate RMDs.

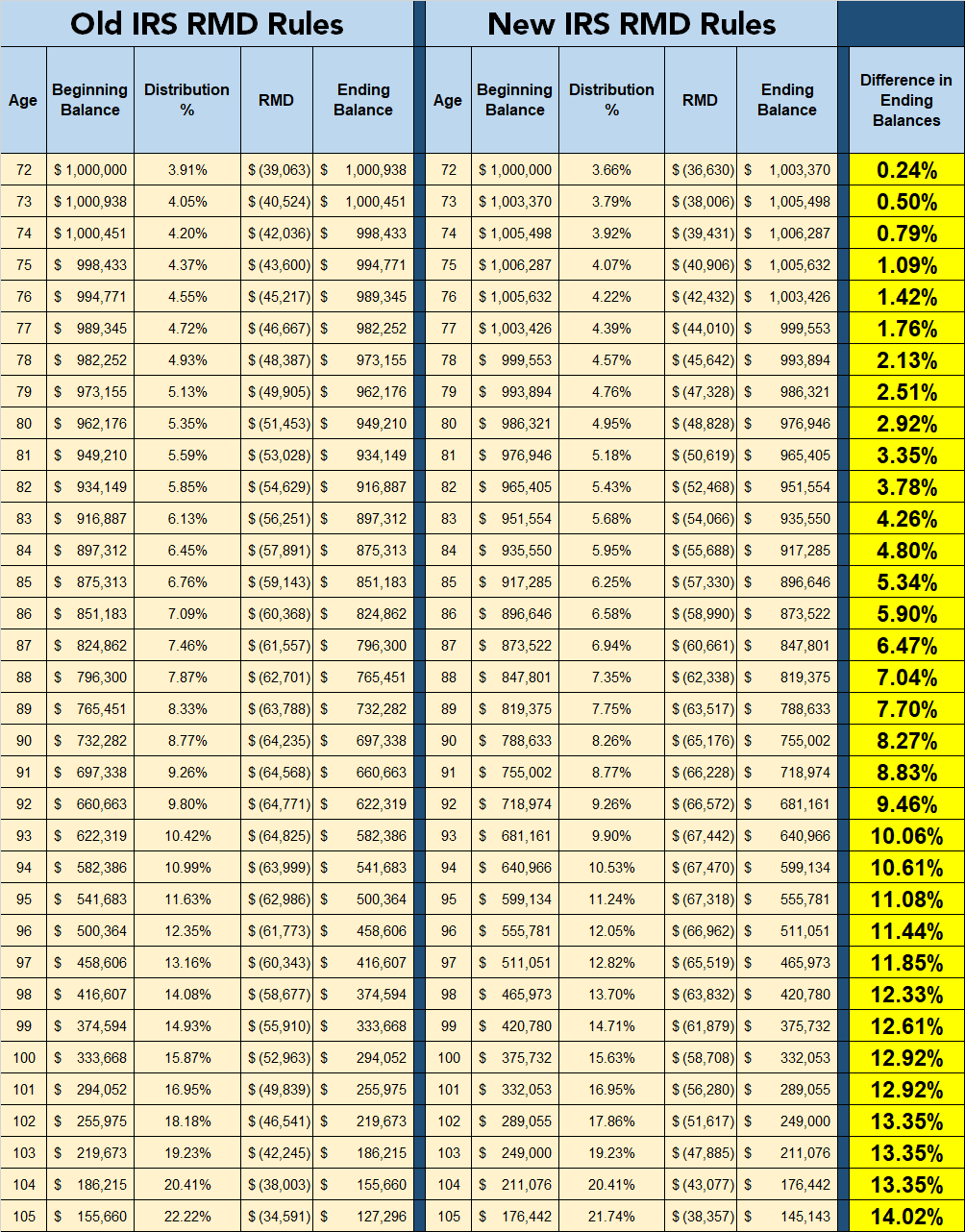

401k RMD calculator RMDs are calculated based on your life expectancy so that payments will last throughout your expected lifetime. The Calculator does not consider the effect of taxes on the RMD withdrawn and the amount owed in taxes on the withdrawal is not. A lower RMD means you may have a larger account balance for future years and your 2022 taxable income will most likely be reduced.

IRA Required Minimum Distribution RMD Table for 2022. I deferred taking an RMD in 2020 and I took an RMD in 2021 using 295 as the life expectancy divisor. Retirement Strategies Tax Estimator.

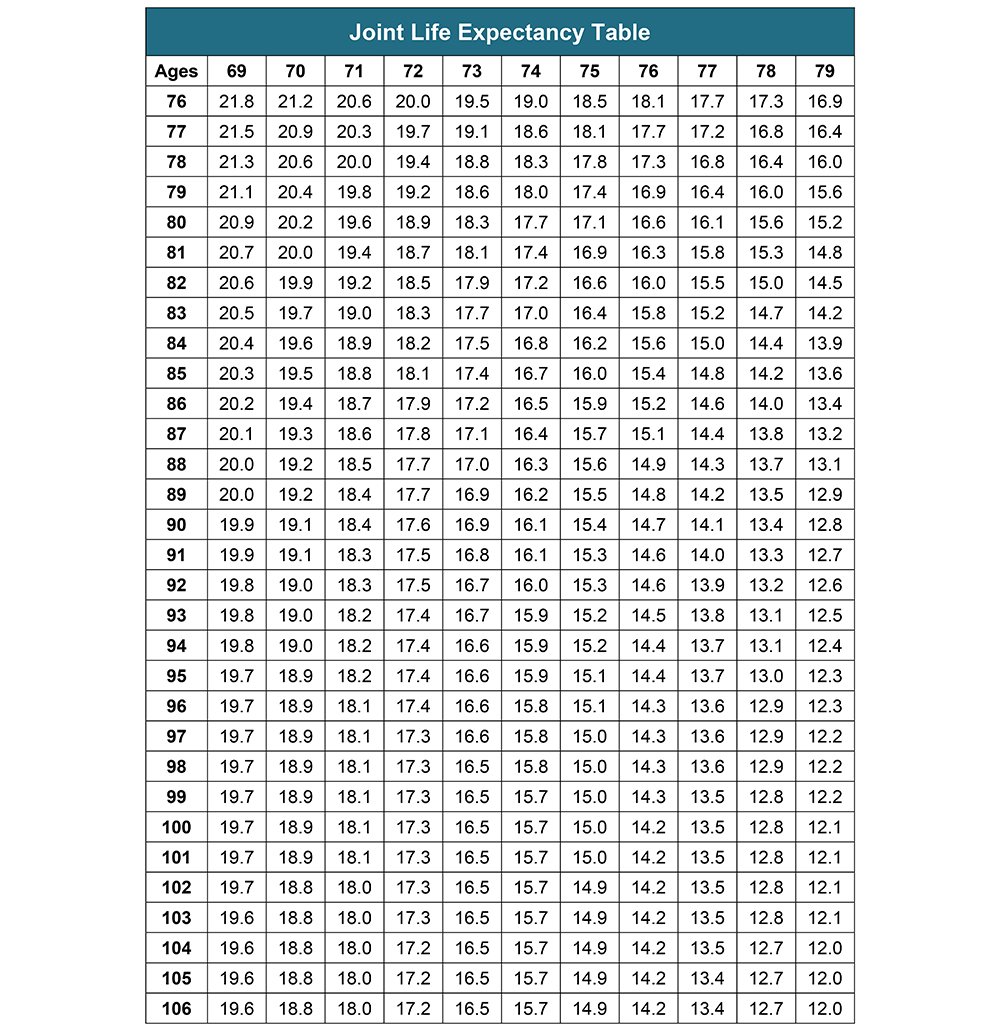

Use this calculator to determine your Required Minimum Distribution RMD. A required minimum distribution RMD is the amount that traditional SEP or SIMPLE IRA owners and qualified plan participants must begin distributing from. There is another table for IRA account holders with spouses 10 or more years younger where the spouse is name as the sole beneficiary.

You can look forward to somewhat smaller required minimum distributions RMDs from your IRA and company retirement savings plan beginning in 2022. Failure to do so means a penalty of 50 of the required RMD. This calculator has been updated to reflect the new figures.

Thats because the IRS released new life expectancy tables for 2022 which impacted your RMD calculation. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705. Please speak with your plan administrator for details.

The calculator will project your RMDs for all future years when you enter your estimated rate of return. This calculator has been updated to reflect the new figures. Non-IRA retirement plans such as 401k or 403b plans may have different deadlines.

On an annual basis each RMD must be calculated separately if you have more than one retirement plan. You can now keep more money in your tax-deferred retirement accounts thanks to lower required minimum distributions RMDs. If youve turned 72 this year you have the option to complete your first RMD by April 1 of next year.

Required Minimum Distribution - RMD. The table is very lengthy as it has every combination of ages for 10 spouses 10-years apart in age. If you have multiple IRAs you must calculate each account individually but you can take your total RMD amount from one IRA or a combination of IRAs.

Required Minimum Distribution RMD Calculator. This suggests a possible upside of 122 from the stocks current price. For more information consult with our tax advisor.

31 2022 and by Dec. Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement. The IRS has published new Life Expectancy figures effective 112022.

Required Minimum Distribution RMD - Future Projection The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually starting the year you turn age 72 or 70 12 if born before 711949. If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. On average they expect the companys share price to reach 26640 in the next twelve months.

31 of each year. Determine your required retirement account withdrawals after age 72 Retirement Income Calculator. The amount you will be required to take each year is a small portion of your account which is determined by dividing your prior-year end account balance by your life expectancy factor.

You can use Vanguards RMD Calculator to estimate your future required distributions when youre putting together your retirement income plan. If you do this youll need to take two distributions in the same tax year. This table provides more favorable ie.

If you defer your first RMD 2022 RMD until April 1 2023 please note you will also need to take your 2023 RMD before December 31 2023. Do not use this calculator for a first RMD deferred from 2021. This can be very useful when youre tax planning for retirement because larger distributions.

31 each year after that. Most non-spouse beneficiaries will be required to withdraw the entirety of an. This calculator has been updated to reflect the new figures.

The new rules and life expectancy tables are in free IRS Publication 590-b available on the IRS. If you were born. However I did receive a notice last year from my IRA fixed index annuity of what my withdrawal for the year of 2022 needs to be but DID NOT receive a notice from my 401k retirement fund.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. Therefore your first RMD must be taken by April 1 of the year in which you turn 72. The IRS has published new Life Expectancy figures effective 112022.

Irs Change Will Decrease Rmds Beginning In 2022 Level Financial Advisors

Your Search For The New Life Expectancy Tables Is Over Ascensus

Where Are Those New Rmd Tables For 2022

3 Reasons The New Rmd Tables For 2022 And Beyond Are Overrated

Inherited Ira Rmd Calculator Td Ameritrade

Rmd Calculator How To Calculate Ira Rmd Michael Ryan Money Financial Coach

![]()

Blog

Irs Wants To Change The Inherited Ira Distribution Rules

Your Search For The New Life Expectancy Tables Is Over Ascensus

Where Are Those New Rmd Tables For 2022

2

Good News For Seniors Rmd Formula Changing For First Time In Decades

New Guidelines For Your Required Minimum Distributions Rmd Coming In 2022 Paul R Ried Financial Group Llc

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

:max_bytes(150000):strip_icc()/ira-5bfc2faa4cedfd0026c1d618.jpg)

Required Minimum Distribution Rmd Definition

What Is The Formula For Calculating An Rmd Retirement Learning Center

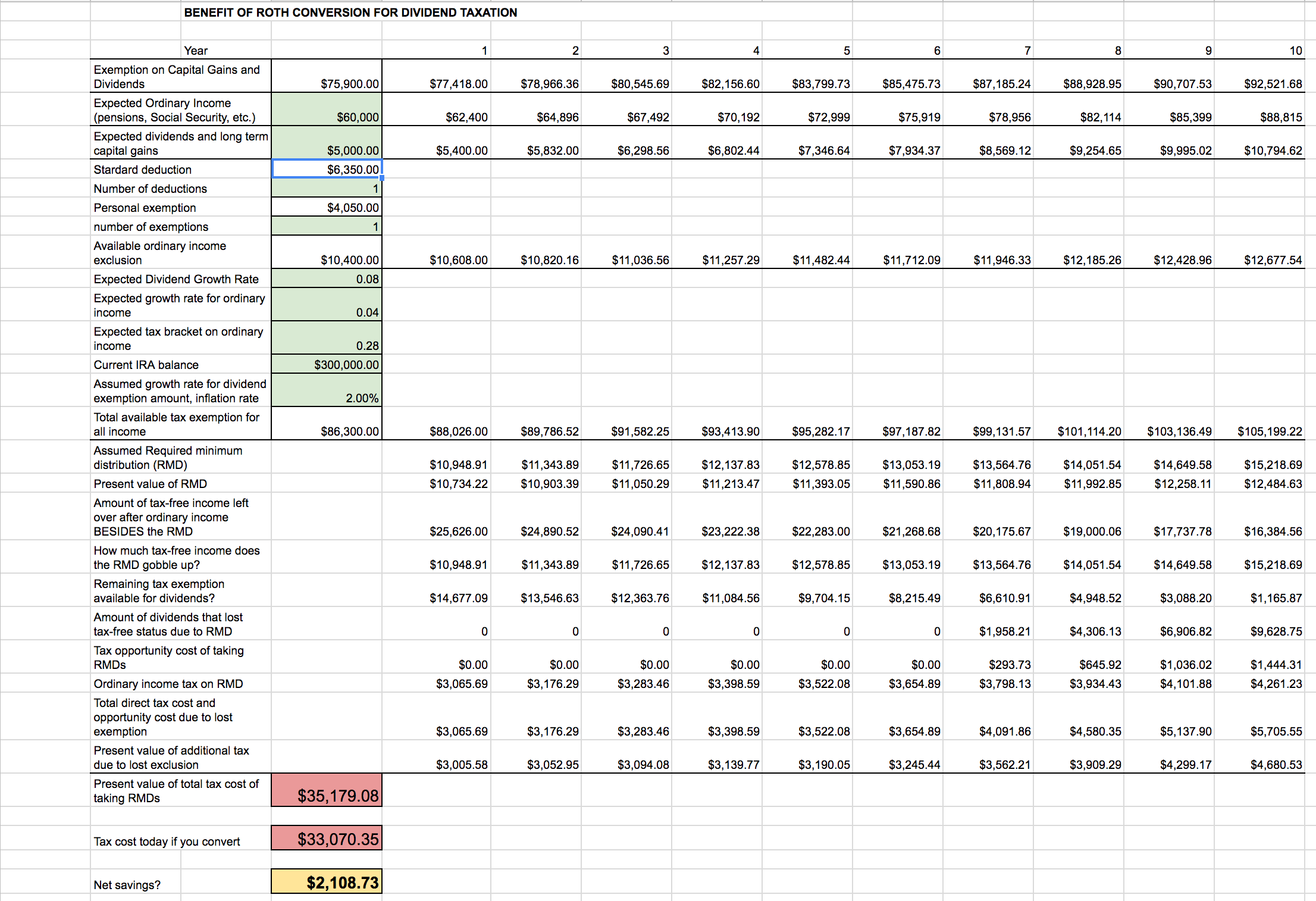

Roth Ira Conversion Spreadsheet Seeking Alpha